eToro is a popular online trading service available to Malaysians. The multi-asset investment platform has attracted over 13 million investors worldwide because of its accessible interface, easy-to-use social trading system, and undeniably catchy ads (you might have seen them once or twice).

After looking around, we’ve determined that these are the top six questions asked by Malaysians about eToro. And we’ve got all the answers.

Table of Contents

1. What is eToro?

eToro is the world’s leading social trading platform. Imagine Facebook or Twitter, but filled with like-minded folks with a hunger for investing. Share updates, tag people, post on your wall, leave comments, private chats and more.

eToro is a brokerage and social media platform rolled into one.

On the brokerage side, you get all the standard features. Trade from an extensive selection of stocks, commodities, cryptocurrencies, ETFs, currencies and indices. eToro also comes with a full suite of professional tools to help you track and invest your hard-earned savings.

2. What Is eToro Copy Trading And Is It Really That Easy?

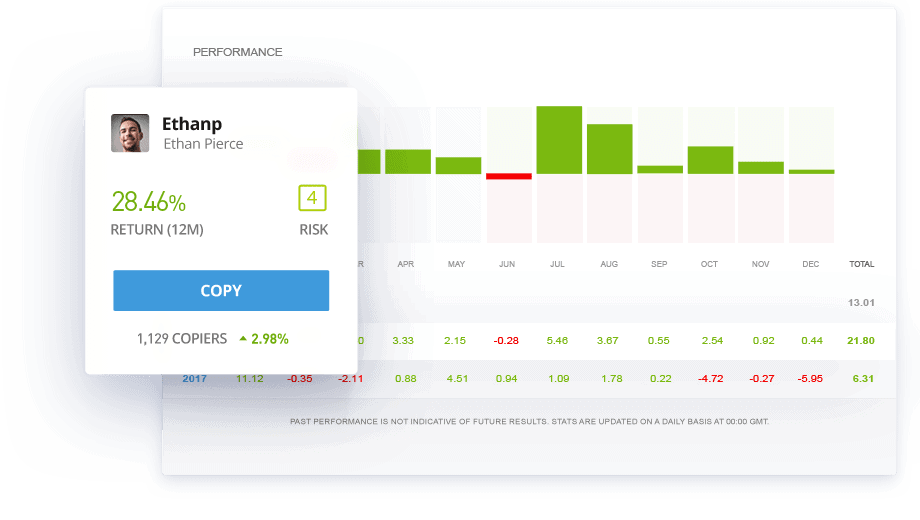

Copy Trading is eToro’s signature social trading feature.

As the name suggests, Copy Trading lets you allocate some of your funds to replicate the trading actions of another trader. When a copied trader makes a trade action, the platform helps you make the same trade with your allocated funds. This is performed automatically without incurring extra costs or effort.

eToro Copy Trading saves you a lot of time and effort in research. The feature removes most mistakes new investors make when first investing in the market.

3. Which eToro Popular Investor Should I Copy?

eToro has no shortage of popular, wise investors for you to Copy Trade from.

From this list published by eToro, the top popular investors from Asia are Spark Liang (Teoh Khai Liang, 60% annual return!), Chien Chen Lin (23% return), Sara Xiushuang Wang (51% return) and Tommy Irawan (18% return).

Spark Liang is the only Malaysian on this list and has the highest annual return.

Picking the right eToro investor to copy is important. You may want to decide based on your risk tolerance, trading style, and of course, the trader’s past performance.

But that’s not enough. You should also dig deeper and look at key metrics such as how long they’ve been trading, the consistency of their results, as well as how active they are on the platform.

4. Are eToro Fees Expensive?

eToro does not charge broker fees for opening or closing a position for stocks listed on US stock exchanges. Aside from zero-commission stocks, there are also no management or quarterly fees.

The only eToro fees investors have to worry about are a slightly higher currency exchange fee and a fixed $5 withdrawal fee.

5. How Do I Deposit Money Into eToro?

Funding your eToro account is easy. Malaysians can setup any debit or credit card with an eToro account. You can also perform an electronic bank transfer. In addition, the platform accepts payment e-wallets such as Paypal or Skrill.

The minimum first deposit amount is $200 (when converted, around RM815), with subsequent deposits at $50 (about RM215) minimum.

Do take note that the currency conversion rate will be slightly higher due to spread. For Malaysians, a good tip is to use credit cards as your deposit method due to better conversion rates over bank transfers.

6. Is eToro Legal In Malaysia?

eToro operates legally in the Asia Pacific Region (which includes Malaysia) under the Australian Securities and Investments Commission (ASIC), Australia’s version of our SC.

However, the platform does not hold a license with the Securities Commission Malaysia (SC). If anything happens, you might not be covered under Malaysian law and will have to seek legal recourse under Australian law.

Disclaimer

This content on this website is intended for general informational purposes only and should not be construed as any advice on any specific facts or circumstances.